Augmented VC, when the old fantasm is becoming the new normal

Recently a lot of founders I am in contact with confessed that they received calls from VC just after they incorporated their company or after they updated their Linkedin status. Here is an explanation of a deep transformation that is happening on early-stage investment.

The whole world of finance is driven by data. Most investment decisions on public markets are motivated by a careful analysis of the different ratios (P/E, Earning per Share, Quick ratio …) while traditional private equity firms focus on EBITDA and a careful cash flow analysis.

20 years ago, VCs were craftperson of the investment, and the main part of the European protagonists were €50m funds that operated with very few people. With the growth of the tech ecosystem, VC firms have grown, and VC is now a real asset class with solid teams and billions under management. With this growth, the competition became also more important between VC firms, and data became an opportunity to make a difference.

At daphni, we took the opportunity to leverage public data sources a while ago. This is both a way to support our portfolio companies by sharing data on the market and on the competition as well as a way to source interesting companies more efficiently.

What Exactly Is An Augmented VC?

There are tons of interesting articles explaining how VCs are levering data to be more efficient (this is my favorite one!). The short version is that:

- The two main goals achieved through data are sourcing automation and faster analysis of the companies.

- The main part of the data which is leveraged today regards: Linkedin data, employee growth, number of app downloads, number of hits on a website, the official register of created companies…

- When you deal with small companies, you have to deal with weak signals that are lost in a lot of noise and it actually reduces a lot the scope of data that you can use in real life.

- US VCs have a clear lead on this part, a few European funds have also a good focus on it.

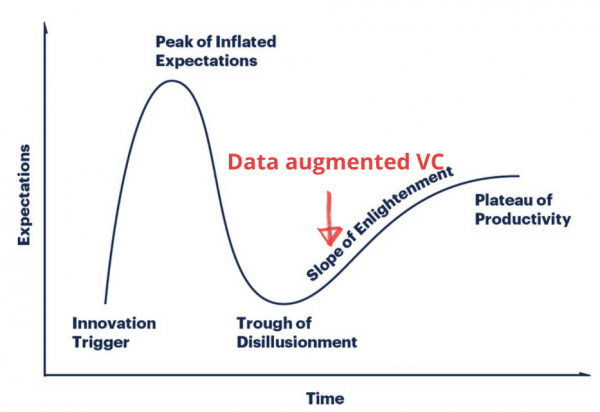

Is It Something New? Definitely not! The Augmented VC is a recurring topic among VCs for a while, leading many people to skepticism on the real support of algorithms to investment teams. When I was trying to break into VC three years ago, nearly all the tier-one European VCs firms I met had a data scientist (or equivalent). Four years later, no one among the people I met that we’re working on data at that time is still in a VC fund. The main reason that came was the low usage of such tools by the investment team which relied mainly on their personal network to source deals.

Why Is It Different This Time?

First, you only evolve when you have to. The level of competition four years ago was probably not important enough to be a real driver for the phenomenon. The current state of the market is not that there are more deals but there is more money into a fewer number of deals which are far more competitive than they were years ago. As a consequence, many investors are going earlier on the value chain. Traditional Series B investors are doing Series A, Series A investors are doing Seed and Seed investors are doing PowerPoint deals in a very aggressive way.

While it is hard to back it through data, my feeling is that the second wave is different also because the need of data actually comes from investment teams. They understand that competition has leveled up and that they actually miss a part of the important deals with the traditional networking approach . This phenomenon is of growing importance since even accelerators that historically feed the VCs with early deals sometimes discover companies after a good part of the early-stage VCs.

As a consequence, investment teams are more involved in the process, resulting in the creation of better tools based on data which are actually used. But the growing impotance of these tools also feed this trend of being more aggressive into early deals.

What Are The Consequences On The VC Industry?

The job of a VC investor is evolving, but algorithms will definitely accelerate the phenomenon. The job of a VC is to deliver a clear value proposition to LPs and Entrepreneurs. On the investment side, the main action is to source, evaluate, invest, support and exit. The first one concentrates a significative part of the efforts of an investment team while they will gradually being more commoditized.

However, that would be a lie to affirm that network doesn’t count anymore. As Venture Capital is a people business, the proprietary network will definitely keep bringing an important part of the qualified deal-flow but the importance of having another sophisticated quantitative approach is going to increase as a complementary source of qualified deal flow generation

While proprietary deal-flow concept does not really exist anymore, the current aggressivity on VC round will not decrease. VCs that already focus on tech will also have an edge as they will have the possibility to leverage several years of data.

What Does It Tell About Diversity?

The main drawback of this system is that it creates a lot of noise. The system will flag the creation of a bakery or a hotel, that’s why you have to create filters to reduce these noises.

Developing these filters is also the opportunity about thinking what you are looking for in priority. The truth is that there are deals that you can’t miss in our job: serial entrepreneurs with experiences that are just an unfair advantage for them, C-level of companies that have a deep knowledge about a specific area, people with experiences that are really uncommon… This is probably what most VCs do. Then you have to define other criteria that are the fund secret sauce.

However, and it is especially important for us, it doesn’t mean that we review only this kind of deal. There are no rules in our job and this is a business where you are looking for outliers, and by definition, outliers don’t follow rules… For all founders who want to apply, this is the place, all the investment team reviews 100% of the opportunities.

Who Are The Victims?

The biggest and only weapon of BAs is their network. As said previously, BAs do not have access to the same tools that take VCs from months to years to develop. Their network power will be significantly decreased by the aggressivity of the early-stage fund and they might have difficulties accessing competitive seed round.

At daphni we digitized the VC approach since our inception by creating our platform which allow daphnipolis to collaborate and support portfolio companies. Quite quickly, it became obvious that an approach around external data was a very smart way to leverage what we already used. We have developped different tools to automate startup sourcing, and our roadmap is still busy (kudos Sophie Percheron).

We know the value of the business angels, and the truth is that we can’t invest in all the promising startups that we detect early. That’s why we created Da New Deal, a newsletter where the daphni team proposes 3 very young startups that are still under the radar. They are flagged by our algorithm but exclusively handpicked by the team. The point of this private newsletter is just to share them, it doesn’t mean we invest (and it doesn’t mean we don’t!), it doesn’t mean they are fundraising, it doesn’t even mean that we met them. It just means that we think they have something special.

As there is a lot of work behind it, we want to keep the list of people who receive it quite small, with value-added people we want to work with. If you want to be part of it, please write us to: [email protected]