Exits part 2: Who is the best buyer for you and how to approach it?

I always wondered what it was like for an entrepreneur to sell his own start-up. This is something deeply powerful for the entrepreneur who has put all his passion, faith, and devotion into it, losing his/her responsibility and control over the project. It also has a specific taste also for the investors who have engaged their credibility and energy to develop it to its full potential. Such transmission is truly symbolic, and it’s called EXIT. Unfortunately for my greedy curiosity, information about this exciting topic remains very hard to find. One reason for that is the relatively early maturity of the European ecosystem, but things are definitely moving on. To answer my burning questions, I was lucky enough to discuss with some of the latest coolest protagonists of the industry. And today, I am more than pleased to share with you my findings!

This series started from the interview of the serial entrepreneurs Marc Simoncini, Bruno Maisonnier, and Alexandre Lebrun. In other words, I was pretty impressed! Yet other questions have arisen… I had the chance to interrogate various personalities with very extended experiences on the topic and I was not disappointed:

- Patrice Thiry is the founder of ProwebCE that has been sold to EdenRed. In the course of his 20 years adventure, Patrice went through IPO, public to private process, VC fundraising, the acquisition of 13 companies, a private equity LBO, and finally an exit. Patrice is now Business angels in more than 20 start-ups.

- Ronan le Moal just left his role as CEO at Credit Mutuel Arkea and led the acquisition or the integration of companies such as Fortuneo, Leetchi, Bankin, or more recently Budget Insights. Ronan is now an entrepreneur and board member at Memo bank.

- Aurélien de Meaux has created Cheerz after leaving school. He has raised €6m with VCs before being bought by Cewe in February 2018 which took 80% of the company for €36m. Aurélien is still leading the company.

- Thibaut Revel is Managing Partner at Clipperton Finance, one of the main investment banks in Paris which operates both in tech VC rounds and tech exits. He spent the last 10 years advising some of the most interesting projects in Europe.

Who Are Your Potential Buyers?

Let’s say it, if your company is worth more than a billion, is highly profitable with great growth and great unit economics, then IPO is probably your first option to keep the lead. However, private equity funds can also be an option if your EBITDA offers the opportunity to leverage the transaction with debts. Otherwise, corporate development deals still account for 80% of the deals in France according to Avolta. In this case, you will need to establish the list of your potential buyers by classifying them into 3 main categories:

- Great acquirers that actually need you for very strategic purposes.

- Potential competitors (which complexifies the deal since it is hard for you to totally open your books).

- A broader scope of companies that could have a less direct interest.

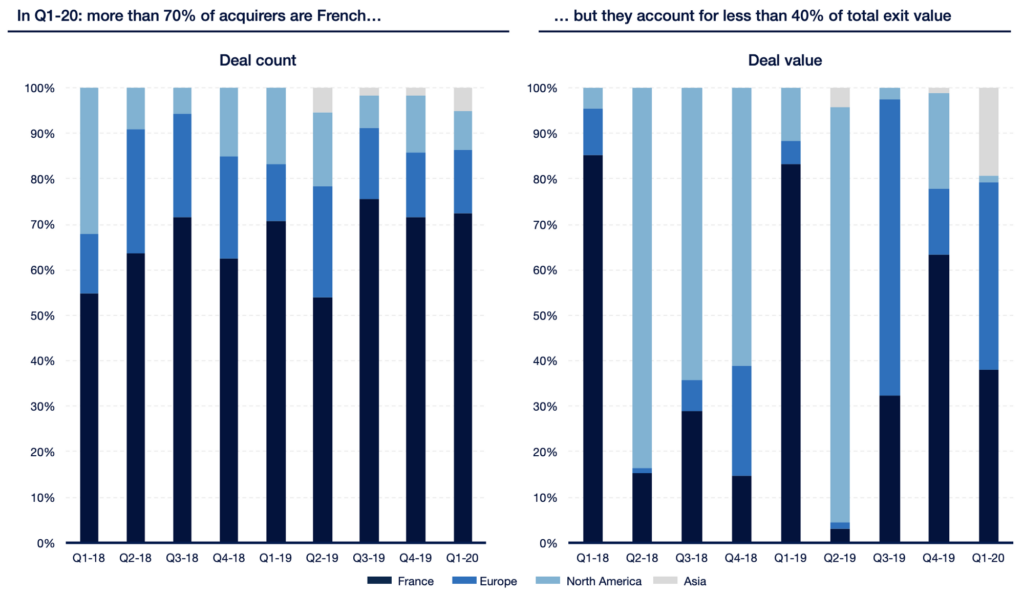

For French startups, while the majority of acquirers is French, the most successful exits are actually done with US acquirers (see below).

The Selling Process Starts Earlier Than You Think

Most startups wait far too long before they start developing relationships with strategic partners. Being focused on their product, raising funds, and engaging with their customers, startups often overlook a key activity: developing relationships with relevant strategic partners. Why? because it takes time and methodology to be acquired.

According to Thibaut, a very important point is to be known by the operating team. As a director of the M&A, the first thing you do when you hear about an interesting opportunity is to call the leader of the relevant department to have feedback about the startup. Let’s make it clear, it is already a very negative start if they don’t know you. After having met Pumpkin’s founding team, the first thing that Ronan achieved was asking his team feedback which was super positive. Of course, you can’t know all your potential acquirers, but it is definitely not something to neglect over time. An interesting quick win for the companies is to be present on reports that offer visibility to the corporates such as Gartner reports for instance.

In the “Magic Box Paradigm: A framework for startup acquisitions” (that I highly recommend), Roizen Ezra writes: “Over the time, the conversation should be driven by a big idea, so big that the strategic Partner feels the idea can be reached only via acquisition. But it has to be their idea. The idea has to be built from their organizational DNA, articulated in their language, and aligned with their corporate mission and values.” While this is not a proper representation of all the acquiring process, I still think there is something important regarding the way you need to present the company to the corporate.

The Flirt, or How to Engage the Conversation

This is probably obvious, but you are never officially selling your company. In that “non-selling” process, the first step is to initiate the first contact and this part is also in the corporates’ hands. As the CEO of Crédit Mutuel Arkéa, Ronan had a rule: give a chance to any entrepreneurs by meeting them at least 20 minutes. It may not seem obvious for a busy CEO of such a company to add this task to its busy agenda, but Ronan considers it is part of his job and it is critical for the future of the company. And as a matter of fact, this is the way he met Leetchi or Pumpkin that they finally acquired.

As for fundraising, trust plays a key role in the acquisition process. Trust is easier to build over time by seeing the company growing, and by creating deep relationships with the founders. Patrice Thiry provides a very good example of that since it was the company of one of his early business angels (Philippe Dufour) who initiated the discussion for EdenRed for the company to be bought 15 years later.

Aurélien describes a similar process for Cheerz. As the photography world is reduced to a limited number of actors, they actually knew Cewe for a while. They had the time to measure the fit between the teams and the common vision. When the time came, it helped a lot to accelerate things.

Process: Speed and Key Decision-Makers

An important point in the sales process is to understand who is your advocate in the company, and what is his/her level of power internally. An obvious point that makes your life far easier is that you need to have key decision-makers involved very early-on into the process. The main risk is to lose a lot of time on focus by talking for months with people that don’t have the power to make the deal happen.

As CEO of Crédit Mutuel Arkéa, Ronan le Moal insists on the fact that as a huge corporation that wants to work with the best startup, you need to play with their rules. “When you light the wick, the delay is in days and not in months. If the project is strategical, the best way to show it to the entrepreneurs is to be fast”.

Are All The Deals Intermediated?

There are actually several ways to sell a company. Sometimes, you don’t plan to sell the company (I mean you are really not selling) and you receive an unexpected offer. In this case, you will consider the offer only if it makes sense for you. The other main case is to start a process with an investment bank.

In both cases, it can make sense to hire an investment bank to let the market decide what is the fair valuation of your company. This is actually the case for the vast majority of the deals that are exited at more than €30m. You can have different configurations:

- Only an advisor to assist the buyer if they are not very experienced

- Only an advisor to assist you as an entrepreneur

- Having advisors on both sides

Pros and Cons of Hiring an Advisor

Hiring an advisor definitely makes your life easier:

- You often sell a company only once in a lifetime while buyers are often far more experienced. This is especially tricky on some parts of the negotiation such as the earn-out (see below). These parts could be highly technical and have a tremendous influence on the amount of money you ultimately get as an entrepreneur.

- An important point is to discriminate between the curious potential buyers who just want to know more about your company and who don’t buy and serious potential buyers. This is a common practice in the area, as it is very attractive to have the opportunity to have access to all the critical information about your competitors. This is a business of people, and experienced advisory knows people’s reputation.

- An important point is also to preserve the reputation of a company. By mentioning to the market you are selling the company you also decrease its value in the long term especially if a company supposed to buy it finally gives up after months of due diligence and negotiations. It could also create a kind of uncertainty for your clients and be harmful to the business.

- You want to be introduced to the maximum number of great potential acquirers. A great banker can help you by extending the pool to the US or Asian actors that you don’t directly know.

- You need someone involved in the negotiation to play the bad cop. It could be your investors, an attorney, or… an advisor.

- Your interests and the ones of the investors could be a bit miss-aligned at some point and a third party to lead the negotiation can make sense. As a consequence, the contract with the investment banks is often signed by both the investors and the entrepreneurs.

- Processes are uncertain and offers don’t necessarily come when you have time to spend on it. As for fundraising, while it takes a substantial part of your time, stakeholders are still expecting your metrics to keep a very high pace. In this context, having experienced people spending their time on it is definitely valuable.

On the other hand:

- Advisors are definitely expensive, contracts often include minimum success fees plus a % of the transaction.

- You can be tempted to keep direct control on negotiations, especially if you already have bonded with your potential buyers.

- Some people fear that M&A boutiques can have shadow deals with the corporates. Corporates are also important clients of M&A boutiques and it could create conflicts of interest.

Despite these drawbacks, in the VC industry hiring an M&A boutique is the norm more than the exception.

How to Choose your Advisory?

Let’s be honest, even if you’re a chill person, the M&A process is very stressful and you often have very tough moments during the process. In this context, the mutual fit with the advisor is important, and the best is to know him/her for a while before starting the process.

Another important point is to choose someone who is super well connected to your sector. As shown by Guillaume Durao in his article about the selling process of Clustree, meeting the right person at the right time is key.

Dual track: a choice to make

Series B is a very specific period in the life of a startup for 2 main reasons:

- The company is supposed to reach proven unit economics that allows it to be acquirable.

- Raising a Series B often supposes to reach a very important post-money valuation regarding the average exit of a tech company (roughly €25m in France). Making it uncertain for founders to find an acquirer and to get a good part of the money as they are often paid after reimbursing the investors.

This is exactly the situation that Aurélien has lived with Cheerz. In late 2017, Cheerz has raised a total of €6m and had a solid position in France, Italy, and Spain. At that point, Aurélien had 2 options, raising 15 or €20m to double down in Europe or join forces with an acquirer such as Cewe. Aurélien led the two processes in parallel. Obviously, the tones of the conversations were really different since VCs are excited by huge growth opportunities while industrial players are really more concrete. After meeting a lot of people at Cewe and balancing the pros and cons, Cheerz founding team decided to join forces with Cewe. An important element for Aurélien was all the people involved in the adventure.

Being bought by a startup, a specific situation

An important difference when you are a startup that acquires another startup is that you don’t have the luxury of time nor to fail. Patrice was in the situation of the acquirer several times has he has bought 13 companies during his journey at the head of ProwebCE. He allows us to understand very well the situation of the buyer by highlighting some very interesting points:

- Make the peace: When you create a company into a new market, you often compete with some other startups for the same contracts or the same recruits for a while. As a consequence, a natural animosity often increases with time between you and your direct competitors. When it is often seen as a one-way road, Patrice’s history shows that even very hard relationships can ultimately turn into very successful alliances. During his journey at ProwebCE, Patrice has been in very tough competition against Cenet lead by Gonzague Bellanger for a few years. The situation was hard on both sides and after an epic battle to win a tender for Total, Patrice ultimately decided that their war was useless and that it was time to assemble forces. ProwebCE acquired Cenet, and the fierce competition ultimately turned into a very fruitful alliance. Today Gonzague is still part of ProwebCE. Both Patrice and Gonzague’s lives became far easier after this alliance. Patrice is now a strong advocate of merging with your competitors when the right time comes. It is more than just basic game theory on the economics of the new structure, it is also about focus, and spending your energy on the right topics.

- Convince everybody: For each acquisition, Patrice took the time to go on-site and to meet every employee of the company to explain his vision. He thought it was critical to take the time for all of them and to show that he cared about them and he wanted to work with them. For a 60 people company, he spent a full week on-site, meeting personally all the employees of the company. This process is extremely time-consuming but Patrice estimates that it is necessary.

- Treat people as you would like to be treated as a founder: In this case, while corporate processes are less important, the blues of the entrepreneur can also exist. The right way to prevent that is to offer as much liberty as you can for the founders of the acquired company into the new structure. For Patrice, it works super well since many of the founders of the company he acquired are still working for ProwebCE today.

Let’s see in the next part what are the precious advice of our protagonists once the deal is done!